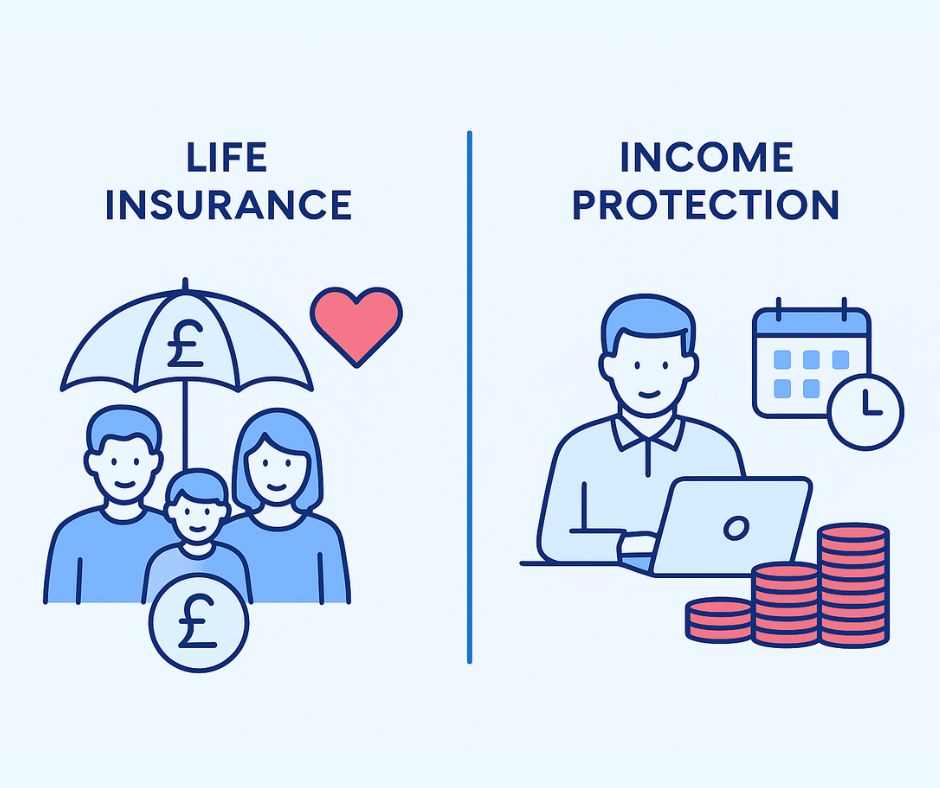

What’s the Difference Between Life Insurance and Income Protection?

Discover the key differences between life insurance and income protection. Learn which cover suits your needs and how Fosters Financial can help protect your family and income.

Clear, practical UK guidance to help you decide whether life cover, income protection — or both — are right for you.

Quick answer: How life insurance and income protection differ

People often ask, “Life insurance vs income protection — which do I need?” The short version:

- Life insurance (term life or whole-of-life) pays a lump sum when you die — it’s designed to provide financial support for your dependants (mortgage, debts, school fees).

- Income protection pays a regular monthly benefit if you’re unable to work because of sickness or injury — it replaces part of your income for months or years while you recover.

Both products protect against different risks. Many households benefit from a mix of both, depending on their mortgage, family commitments, and employment situation.

Life insurance: what it does and when it pays out

How it works

Life insurance typically pays a tax-free lump sum to named beneficiaries if you die during the policy term (term life) or — in the case of whole-of-life policies — whenever you die. The purpose is usually to clear debts (like a mortgage), cover funeral costs, and provide an inheritance or immediate cash for the family.

Common uses

- Paying off the mortgage

- Replacing a partner’s lost income for dependants

- Covering childcare or education costs

- Clearing outstanding debts

Typical limitations

Life insurance does not pay out if you are very ill but still alive — that’s where critical illness cover or income protection can help. Additionally, some policies have exclusions for specific activities or recent health conditions, so it is essential to review the policy terms carefully.

Income protection: how it helps when you can’t work

How income protection works

Income protection pays a percentage (often 50–70%) of your pre-tax earnings as a monthly benefit if you’re unable to work because of illness or injury. Policies usually have a waiting period (called a “deferred period”) — for example, 4, 8, or 13 weeks — and then pay until you return to work or the policy ends.

Who should consider income protection?

- Self-employed workers or contractors without employer sick pay

- Employees with limited or no long-term sick pay

- Anyone who would struggle to meet mortgage and household bills if their income stopped

Key considerations

Income protection is typically more expensive than life insurance because the policy may pay for many years. You should consider the deferred period, the benefit amount, whether the benefit is index-linked, and whether the insurer calculates the benefit after tax.

Do I need both? Answering “Do I need income protection?”

Asking “Do I need income protection?” means thinking practically about your finances. Consider:

- Are you the main earner? If your household relies on your salary to meet mortgage payments and monthly bills, income protection is usually worth strong consideration.

- Do you have employer sick pay? Generous company sick pay reduces short-term risk, but rarely covers long-term scenarios.

- Do you have dependants? Life insurance protects dependants after you die; income protection protects them while you’re alive but unable to work.

- Can you afford the premiums? Income protection tends to be more expensive; compare deferred periods and indexation options to find the right balance.

For many households, the answer is both: life insurance to protect long-term liabilities (mortgage and family) and income protection to cover living costs if you become ill for an extended period.

How to choose the right policy

Step 1 — Work out the gap

Calculate your essentials (mortgage, bills, childcare) and the shortfall if you lost your income. That tells you how much replacement income you’d need and for how long.

Step 2 — Compare features

Check whether income protection benefits are index-linked (keep pace with inflation), whether life insurance includes terminal illness cover, and whether any critical illness options are helpful for your situation.

Step 3 — Seek local, regulated advice

Speak to an FCA-regulated adviser who understands the UK market and your personal circumstances. A specialist can model scenarios, compare providers, and explain exclusions and definitions of disability or incapacity.

Useful resources

Speak to a specialist — get personalised advice

If you’re weighing life insurance versus income protection or asking, “Do I need income protection?” we can help. Fosters Financial offers tailored, jargon-free advice for Colchester families and workers.

Short FAQs

Does income protection pay out if I still work part-time?

Some policies allow partial benefits if you can only work reduced hours; check definitions and partial disability clauses with an adviser.

Will life insurance cover funeral costs?

Yes — a lump sum from life insurance can be used for funeral expenses, debts, or any purpose your beneficiaries choose.

Can I claim both income protection and life insurance?

Yes — they cover different events. Income protection pays while you’re alive and unable to work; life insurance pays on death (or terminal illness if included).